John D. Rockefeller called thrift essential to living a well-ordered life. Whether or not thrifty behavior contributed to him becoming the wealthiest American in history is debatable. What isn’t debatable is the impact of current economic pressures on American households’ budgets.

Here are five sensibly priced products that will help you stretch your hard-earned dollars without requiring significant lifestyle compromises. The money you save just might make other financial responsibilities easier to tackle.

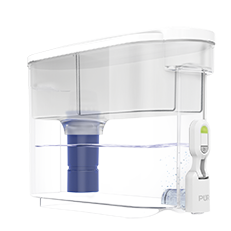

1. PUR Water Filtration System

You’re not still buying bottled water, are you? The big-name brands taking up shelf space at your local store are more expensive than tap water you can filter at home using a PUR water filtration faucet system, pitcher, or dispenser. Many commercially bottled waters are filtered tap water — but much more expensive. By using a PUR faucet filtration system instead of buying bottled water, you can save as much as $30 each week¹!

That’s more than $1,500 per year! Just think of all the ways you can otherwise spend $1,500 this year with the cost of living rising so much.

Next, round up all those reusable water bottles you’ve purchased, received as gifts, and gotten for free over the years. Fill and refill your bottles with cool, clean, refreshing water straight from the PUR product that fits your lifestyle.

You’ll recover the cost of your PUR purchase quickly. (And you’ll keep plastic bottles out of the ocean and landfills.)

2. Coffee Maker

Do you love coffee? Are you nodding with excitement, or is that the caffeine kicking in? Americans love coffee, and we’ve gotten used to paying for it at cafes and restaurants without blinking at the prices. When you’re at your local coffee shop tomorrow morning, blink at the prices. Who knows what they’re based on?

It’s time to be your own barista! Start making coffee at home. It doesn’t have to be complicated, time-consuming, or expensive. And it’s fun! Try different beans, pick your favorite, then get a grinder and a coffee maker. Don’t spend a lot on cool coffee stuff until you’re pretty sure you’re going to continue brewing your own.

Keep in mind that coffee — and tea, for that matter — is mostly water. Want great coffee on the regular? Use great water. You know, the water passing through your PUR filtration system into your water bottles. Saving money on both great-tasting coffee and water? That’s win-win!

3. LED Light Bulbs

You might not spend a lot of time thinking about the lighting in your home or workplace, but you’re probably benefiting from some amount of LED lighting. LED lighting is smart lighting, literally. Thermal management microchips in LED bulbs make them cost more per unit than their incandescent or fluorescent counterparts, but they also last much, much longer.

Replacing all the incandescent bulbs in your home with LED bulbs is a no-brainer. Check out the bulbs they use at work or in stores and restaurants. The money saved long-term — a yearly average of $225 per household, according to the U.S. Department of Energy — makes switching to LED a must.

4. Gas Fireplace

Heating your home can take a significant bite out of your monthly budget. Electricity and heating oil are not getting any cheaper. How’s that fireplace in the living room doing? You know, the reason you fell in love with your place way back when?

Put your fireplace to work. If it runs on natural gas, you’re good to go. If not, look into installing a gas insert. Make a note of what you paid. Use it to heat your house for a month. Then compare what you spent with a comparable month’s central heating bill. You should see savings and be able to calculate how quickly you’ll recover the cost of installation.

Consider getting an air purifier if you use your fireplace as your home’s primary heating source. Honeywell air purifiers with HEPA filtration capture particles from smoke, along with other indoor pollutants.

5. Low-Flow Shower Head

Despite that Seinfeld episode, low-flow shower heads don’t have to equal unsatisfying showers. You probably won’t feel the difference when showering, but your wallet will, in a positive way, when the monthly water bill arrives.

Don’t Let Inflation Burst Your Bubble

All the recommendations offered here involve examining your recurring expenses and finding opportunities to save on them, month after month. You don’t need a Rockefeller-like fortune to be more comfortable in your home during challenging economic times.